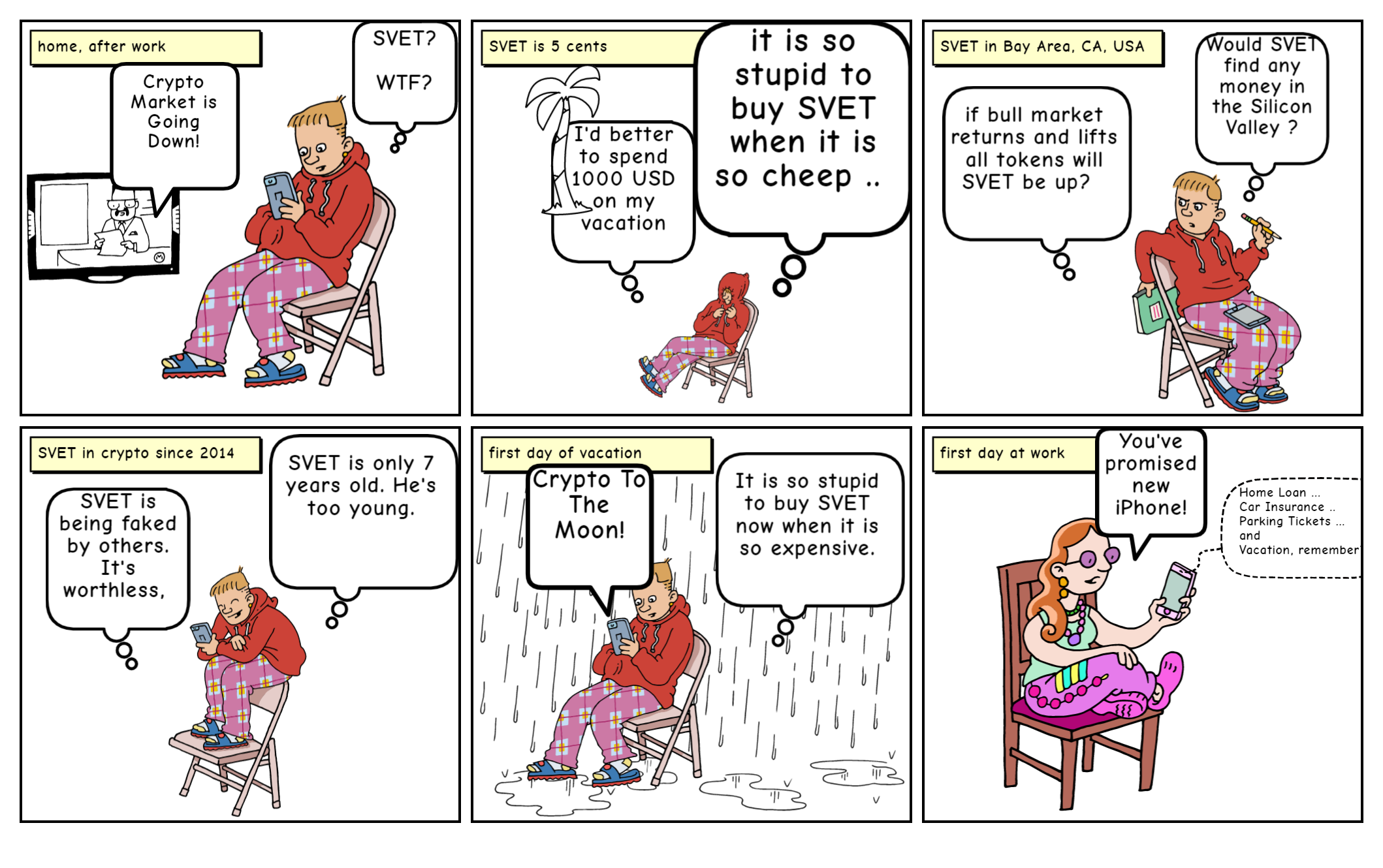

SVET Platform is the digital wealth management solution for HNWI.

(click)Are you looking for the Silicon Valley based qualified investors - Hight Net Worth Individuals (HNWI)?

You can start providing monthly information about your project (filling in a form on svetrating.com, which contains from 4 to 16 questions, depending on the level of details about the state of your projects fundamentals you are willing to publicly reveal). Your ratings and reviews will be then available for HNWI - SVET Platform users.

If your project demonstrates consistent progress through its fundamental parameters improvement (basically, it means that your SVET Rating is growing) our Guardians might choose to review its in one of out groups and publications (including, TG, Medium, LinkdIn and Quora). Note, that SVET Guardians are independent analytics which can't be influenced by the Platform's founders. Guardians will be making a decision about trustworthiness of your ratings.

To get an access to svetrating.com you need to buy and stake SVET tokens (ERC20).

SVET Rating: Will DeFi Replace Banks?

Assesses digital markets participants' prospects by publicly providing regular SVET Ratings' updates of newly listed digital assets. Saves Digital Angels' (long-term investors in digital assets) time and money on analytics researches by pooling analytical talents from across the World.

Rating List >>

SVET Value Can You Trust Silicon Valley Types?

Reduces assets dislocations risks by using smart-contracts-based investments diversifications strategies.

Learn More >>

SVET Index: Time Is Money.

Lowers entry barriers into DeFi projects by providing one-click solution for a fast entry / exit to / from digital assets portfolios.

Build An Index >>

S.V.E.T. Review = System + Vision + Execution + Tokenomics

Harmony: System

"This paper is, definitely, well-written and structured. Moreover, its authors not only managed, in a relatively limited space, to comprehensively present their new consensus protocol (which they called “Fast Byzantine Fault Tolerance (FBFT)” and which, basically, instigates so-named “leaders” to fast-track validation by collecting validators’ votes into the multi-sign and then broadcasting it) but also to critically analyze FBFT and to compare it with already existing protocols." (Harmony Review and Rating)

WaykiChain: System

"Although this 'sandwiched' DPoS architecture makes more difficult for 11 'super-nodes' to collude it still remains possible, specially, when the number of nodes are in hundreds. "((WaykiChain System Review and SVET Rating))

Kyber Network: Vision

Looking at the rate of DEXs’ growth it is easy to forget that not so long time ago, in February 2020, the percentage of DEXs volumes in the total exchanges volumes was actually decreasing (since January 2019 level of 0.1%) to a sub-critical level under the 0.01% :) (Kyber Network Vision Review and Rating (SVET))

Bytom: Execution

" ... the toxic, anti-crypto regulatory environment doesn’t allow most companies in our space to be forthcoming with full information disclosure. "((Bytom Execution Review and Rating)

Baseline Protocol: Tokenomics

" ... the main idea behind BP is to establish and to maintain an effective cross-companies-borders exchange of sensitive economic and financial data (without breaching key secrecy and confidentiality internal protocols) in order to achieve measurable gains in productivity, efficiency and quality controls." (Baseline Protocol Tokenomics Review and Rating)

Compound Finance: System

" ... when user wants to issue a loan (or to add ETH to the liquidity pool) the contract mints a required amount of cTokens (using “uint amountUnderlying”), which represent a given asset. Otherwise, in case of taking a loan (or reducing the liquidity by charging back its ETH account) the contract do “redeem (uint amount)”. "(Compound Finance System Review and Rating)

LocalCryptos: Execution

" ... LocalCrypto reports on its site about $60–80 th. in trade daily as well as more than 100,000 registered users from about 100 countries. It accounts for about $26 million in yearly volume on this platform and (given 1% both-sides fees) for $260th in revenues. "(LocalCryptos Execution Review and Rating)

Ripple Lab: Execution

" ... Ripple financial statements are unavailable for public scrutiny but this company regularly publishes on its site, the so-called, “XRP Markets Report”, which reveals that it “sold $169.42 million of XRP in Q1”. That might indicate (speculative assumption) a quarterly cash-flow deficit, which Ripple needs to periodically re-finance on the open market. This amount seems to be quickly growing (in Q4 2018 it was $129.03 mio and showed an increase of 24% in the next quarter)."(Ripple Lab Execution Rating Update (Oct 2019))

SVET Utility Token

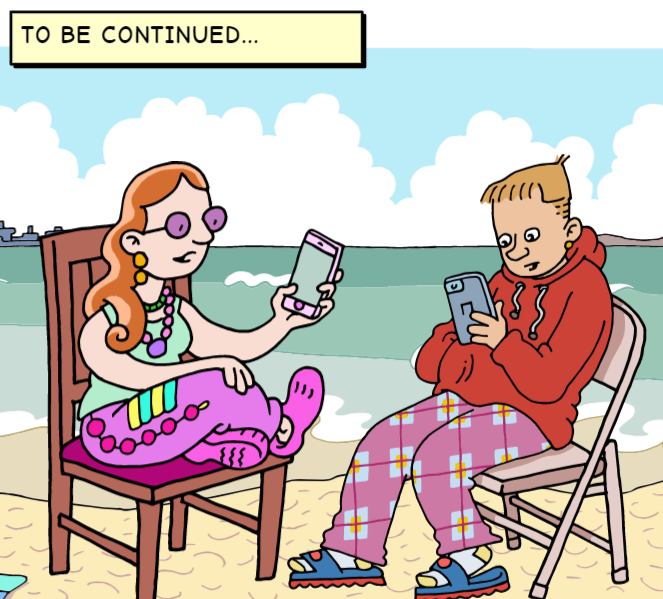

SVET (Silicon Valley Entrepreneurs Token) is the ERC20 token, which is used by investors to reward their personal Analytics on SVET Rating Platform.

There Are 21 million SVET tokens.

1 million SVET - in circulating. 1 million SVET - to be airdropped. 4 million SVET - frozen. 15 million SVET - to be burned.

SVET Is Traded On Uniswap.

Are you looking for SVET? Install Metamask and then go Uniswap.

Stake SVET.

You can add to the Uniswap V.2 pool some ETH together with SVET to earn 0.3% fees from each transaction with the possibility to withdraw from this pool at any time.